In basic, a lower deductible methods you'll be paying more for your insurance premiums. If you choose for a greater deductible, your insurance costs have a tendency to be lower.

Deductible Exemptions, Fortunately, there are some instances in which you don't have to pay your deductible. These circumstances are crucial to maintain in mind when you're calculating the ideal actions to take after a mishap - cheaper car.

Remember that this is the finest strategy regardless of who's at-fault for the mishap. When you're entailed in a crash that's not your fault, you ought to still file the insurance claim with your very own insurer. Your insurer is always going to wish to pay the least amount of cash possible, so if they discover you're not at mistake, they will certainly go after repayment from the other vehicle driver's insurer.

affordable auto insurance auto insurance low cost cheap auto insurance

affordable auto insurance auto insurance low cost cheap auto insurance

Simply bear in mind that you'll only have your deductible covered for you if your insurer is able to get insurance coverage for the whole expense of the problems from the various other insurance provider. With these consider mind, you can discover a deductible for your policy that finest fits your driving requirements from a provider like Progressive.

This web content is created and also maintained by a third celebration, as well as imported onto this web page to help users offer their e-mail addresses. You may be able to find more info concerning this and also comparable material at.

Not known Facts About Automobile Insurance - Official Website

Let's say you simply got in an accident and also your auto requires $4,000 in repair work, but your insurance policy will only cover $3,000. If you're perplexed, comprehending your car insurance policy deductible may be the response - cheap insurance. In this short article, we'll describe what an automobile insurance coverage deductible really is, when you need to pay it, and also whether you should choose a high or reduced one.

You don't really pay an insurance deductible to the insurance policy firm you pay it to the repair shop when they fix your auto - car. Depending on your state, you may have an insurance deductible for various other kinds of insurance coverage, also.

Insurance firms will certainly not be accountable for costs that do not surpass your insurance deductible. Your car insurance deductible does not work like your wellness insurance coverage deductible.

When the brand-new year rolls about, all of it begin again. With vehicle insurance, you pay your deductible every single time you submit a claim. Let's claim you entered into a mishap and filed a crash insurance claim. On your means to the service center, a fanatic hail storm adds even more damages to your car.

There is no limitation to just how many times you pay your deductible in a year. If you file five different accident cases in one year, you'll pay your insurance deductible five times. cars.

See This Report on How To Choose The Best Car Insurance Deductible - Jerry

prices insurers auto car

prices insurers auto car

If you live in an area with frequent poor weather condition, you may desire to pick a reduced thorough insurance deductible to limit what you pay out of pocket. At the exact same time, you can maintain your collision deductible higher to stabilize out your car insurance policy premium.

In that situation, your car insurance coverage premium would cost even more to offset the $0 car insurance coverage deductible. When Do You Pay An Auto Insurance Policy Deductible? Here are the main situations in which you 'd be accountable for paying an insurance deductible: If you create an automobile accident as well as your cars and truck requires repairs, you'll pay your deductible on your accident protection.

How To Pick An Automobile Insurance Coverage Insurance Deductible Since you know what a car insurance coverage deductible is, it is essential to pick the ideal insurance deductible for your circumstance (insurers). You should choose a high vehicle insurance policy deductible if you wish to decrease your monthly costs and if you have the capability to pay it.

If you do not have any type of savings, it's not a smart idea to have a high deductible. You could be the very best chauffeur on the planet, but you still share the roadway with negative vehicle drivers as well as without insurance vehicle drivers (liability). According to the Insurance Information Institute, concerning 6 percent of drivers who had crash protection filed a case in 2018.

You can constantly select a lower deductible while you conserve up a reserve and after that elevate the deductible later on. You need to select a reduced automobile insurance policy deductible if you do not have the capacity to pay a high one, or if you wish to secure your out-of-pocket expenses. A low deductible could be an excellent idea if you reside in a busy location where you have a greater chance of experiencing a mishap.

Getting My What Is Car Insurance Deductible 2022? How Does It Works? To Work

Some programs will certainly reset your insurance deductible to the complete quantity after you make a case, as well as others will reset it to a smaller sized quantity. After 5 years, you would certainly have paid an added $100 or even more to your insurance firm.

What Occurs If You Can Not Pay Your Deductible? If you are not able to pay the remainder of your prices for the insurance deductible, you may have some choices.

low cost auto cheaper car insurance money

low cost auto cheaper car insurance money

Understanding when to adjust your insurance deductible and also when to look around for a new car insurer with inexpensive prices is the safest way to stay clear of high expenditures in the future. Our Suggestions For Vehicle Insurance Searching for automobile insurance doesn't have to be hard. Just make certain to get quotes from numerous service providers, so you can contrast prices.

What is collision insurance coverage? Accident protection helps pay for the cost of repair work to your lorry if it's struck by one more car - credit score.

That means it would not spend for damage to one more individual's vehicle or residential or commercial property. Crash also doesn't cover all damage to your vehicle. Instances of damages not covered are: Burglary Vandalism Floods Fire Striking a pet If you wish to understand even more regarding protection for these type of problems, take a look at the thorough protection page.

Not known Details About Comprehensive Car Insurance: Do You Need It? - Nerdwallet

What is a collision deductible? A crash deductible is the quantity you've concurred to pay before the insurance firm begins paying for damages.

Allow's state you're associated with a crash that creates $1,000 in damage to your vehicle and also you have a $250 deductible on your accident insurance coverage. You'll pay the first $250 in damages, normally to the body store, and also after that your insurance coverage will certainly pay the continuing to be $750 - low cost auto. The above is suggested as basic details and as general plan summaries to aid you understand the various kinds of insurance coverages.

We are so pleased you asked! This is a crucial inquiry one that many individuals answer as soon as as well as never quit to review as their scenarios change. What is an insurance coverage deductible? An insurance deductible is the quantity of money you have to pay from your very own pocket prior to your insurance protection starts - car.

insurance business insurance insurance insurers

insurance business insurance insurance insurers

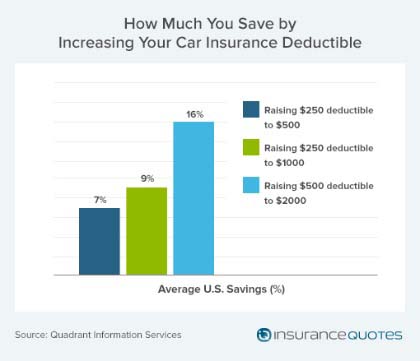

Raising it from $500 to $1,000 might yield a 14 percent cost savings (prices). Once again, these are simply estimates.

liability cheaper auto insurance trucks insurance

And if you don't have to file a claim for 2, three, or 4 years you might save a substantial quantity of cash over time. (FYI: the typical vehicle owner drives for 8.

The Ultimate Guide To What Is A Deductible? - Sonnet Insurance

There are a couple of things to think about when choosing your deductibles, such as your budget, the value of your vehicle, just how much you have in savings that you might put toward car fixings and also the probability that you'll need to make an insurance claim (cheapest car insurance). Example, If you have an older car with fairly reduced worth, you might intend to select a high deductible in order to keep your premiums lower.

Generally, the higher the deductible, the reduced your premium prices for an insurance policy plan. You can see just how much you can save by increasing your deductible Our suggestion is to acquire as much insurance policy as you can pay for. Auto insurance deductibles are typically paid per occurrence, so you will need to pay your insurance deductible quantity out every time you make a comprehensive claim (cheapest car insurance).

What is a detailed deductible? An extensive insurance deductible is the amount of money that you are responsible for paying toward an insured loss. The amount of the deductible is deducted from your claim settlement in the occasion of a covered accident. Typically, detailed deductibles vary from, as cars and truck insurance coverage deductible options differ depending on your state legislations as well as insurance coverage business guidelines (cheaper car insurance).

Why you may not desire a high thorough deductible? A high insurance deductible can indicate that you need to pay even more out of pocket in case of a crash or other protected loss. This can be particularly bothersome if you don't have a great deal of savings or reserve to cover these expenses.

Consequently, you might not have the ability to obtain the Home page full quantity of protection you need if you have a high deductible. Having a higher insurance deductible makes it a lot more tough to get approved for certain discounts. Many insurance business supply price cuts for low-mileage chauffeurs. If you have a high deductible, you might not be able to get these price cuts.

Our How To Choose Your Car Insurance Deductible (2022 Guide) Diaries

One of the most your insurance coverage will certainly payout is the automobile's real cash money value what the car was worth on the market before the damage happened minus your selected deductible quantity (accident). You can negotiate the actual cash value of your automobile in the event of a complete loss by providing different examples of comparable cars and trucks.

Thorough insurance claims and also your prices, The majority of states' insurance policies call for that thorough claims be covered by the plan. The price boost is typically small since detailed claims are not connected to the insurance holder's driving. Unlike obligation or crash claims for accidents, detailed claims normally won't boost your prices. The exception might be if you file several cases in a very brief amount of time.

Understanding the Car Insurance Deductible Insurance, News, Internet

Your vehicle insurance coverage deductible is the amount of cash you would certainly contribute when your insurance coverage business pays for a covered insurance claim. Just how do auto insurance policy deductibles function?

Anytime you're in a cars and truck accident and there are problems to your cars and truck that would be covered under detailed or crash insurance coverages, you'll be accountable for paying the insurance deductible under each of those insurance coverages. If you have numerous automobiles on your car insurance policy, you can likewise choose various deductibles for each automobile.

The Facts About How Does A Car Insurance Deductible Work? - Quotewizard Uncovered

You can select different insurance coverage restrictions for all of them, as well as set deductibles, depending on which insurance coverage it is - car insurance. Why can not you constantly select your insurance deductible? Since not all protections have them and also some, like Injury Security, have them in some states, as well as not others. Deal with your insurance provider to figure out just how to meet your insurance coverage requires.

In short, a higher deductible amounts to reduced insurance premiums. A reduced deductible amounts to higher insurance coverage costs.

When selecting car insurance coverage, you picked the low insurance deductible of $500 (dui). What if you selected a high deductible of $2,500? They have less risk, so you'll pay a reduced costs.

This can be high-risk organization What happens if like in the instance above, you picked a $2,500 insurance deductible however really did not have that cash accessible? When you submit an insurance policy case, you'll be invoiced for your deductible. If you don't have that $2,500 ready to pay you could be embeded a bind with a repair shop.